Effective copyright protection and enforcement are fundamental to the economic viability of the music rights sector. To support market growth and development, it is essential to:

Much-needed legislative amendments and improved procedures are in the works – it is important that these be implemented as soon as possible.

A stronger understanding of music business practices, copyright, and contract law is key to the professional development of all participants in the music ecosystem. To address current gaps, stakeholders should:

These efforts will help individuals capitalise on opportunities, encourage new entries into the sector’s workforce, and foster trust within

the ecosystem.

The long-term health and diversity of the Bulgarian music scene depend on sustained investment in nurturing artistic talent and supporting the creation of high-quality original music. To strengthen this area, it is important to:

These steps will help ensure that artists and labels across all genres have access to the resources they need.

A national cultural strategy with a clear vision for music in Bulgaria is essential to avoid fragmented policies and missed opportunities. To achieve this, it is necessary to:

A commitment to data and monitoring will also support better decision-making and long-term planning. The state must act as a strategic enabler, supporting both culturally diverse grassroots scenes and a commercially viable music industry.

Developing international career paths and business strategies is crucial for the growth and sustainability of Bulgarian artists and music labels. To strengthen this area, stakeholders should:

These actions will help Bulgarian music

reach new audiences and markets.

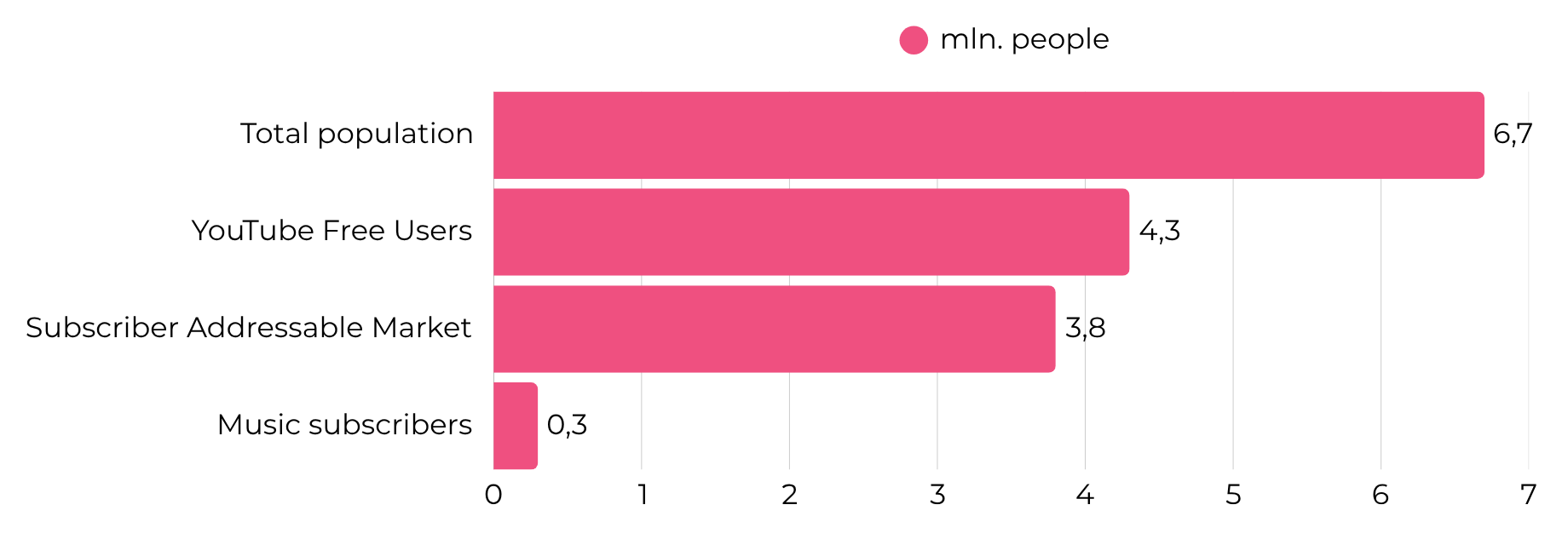

There is a significant cultural issue - the undervaluing of music and expecting it to be freely available, which is reflected in high levels of digital piracy. To address this, the industry should:

While cultural change is complex, consistent communication and a broad-based coalition can strengthen the impact and support revenue generation across the sector.